A great analysis of Trump’s accusation that China is a currency manipulator has just been published by the Timothy Taylor (aka the Conversable Economist: http://conversableeconomist.blogspot.com/2019/08/china-and-currency-manipulation.html).

He shows how changes in China’s currency vs US dollar do not match up with rises and falls in China’s trade surplus with the US, which is at the core of Trump’s accusation.

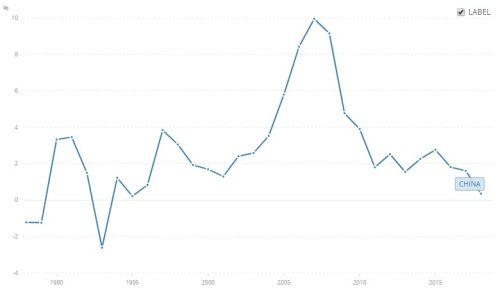

The chart below, which maps the yuan/US dollar exchange rate over the past 30 years, tells much of the story.

As Taylor explains, up to around 1995, the Chinese Government set an official exchange rate. The value of the yuan plunged that year when the official rate was unified with the much weaker market-set rate.

Between 1996 and 2005, the exchange rate barely budged because the Bank of China held it fixed.

From mid-2005 the yuan gradually strengthened, from about 8.2 yuan to the dollar to reach 6.8 yuan to the dollar by mid-2008.

Since then it has been held within the 6 to 7 yuan/dollar band by the Chinese central bank.

Match this up against China’s trade balance.

Chinese exports surged in the early 2000s after the country joined the World Trade Organisation in 2001 (see chart below). China’s trade surplus reached a high of 10 per cent of GDP in 2007 before declining to less than 2 per cent by 2011 and less than 1 per cent last year.

Note how, in the early 2000s, will China’s trade surplus surged, the yuan/dollar exchange rate did not budge, and has stayed within the 6 to 7 yuan/dollar band for the past decade, even as the trade surplus has plunged.

As Taylor argues, especially since 2011 there is no evidence to no support Trump’s complaint that China has been using a weak exchange rate to power its trade surpluses.

In fact, China’s trade is close to balance at the moment. The IMF reckons it had a surplus of just 0.4 per cent in 2018, and thinks it is headed to a trade deficit in the next few years.

Given Trump’s “America First” (read, ‘bugger the rest of you’) focus, it is unsurprising that US Treasury’s gripe is primarily that, regardless of its overall trade balance, China is running a hefty trade surplus with the US.

But this has little to do with the currency and almost everything to do with the American consumer who has, like much of the rest of the world, become addicted to the flood of cheap clothes, toys, footwear, electronics and other goods coming out of China.

By hiking the tariffs on Chinese imports, Trump is imposing a tax on American households by increasing the cost of the Made in China goods they purchase.

He is also distorting global production chains.

Neither will necessarily be very good for the American economy, which is already slowing under the pressure.

Own goals don’t come much bigger.